By: Adeyinka Adegbenro

Authorization rates measure the ratio of successful payments to total attempts. For instance, if a merchant processes one hundred payments and seventy of them are successful, the authorization rate is 70 percent. This metric directly impacts revenue, customer satisfaction, and operational efficiency. High authorization rates mean more revenue captured, while poor rates can signal system issues, like failed authentication, unreliable processors, or friction in the payment flow.

In this article, you’ll learn about the different stages of a payment and where declines typically happen. You’ll also learn about strategies that can help boost your approval rates, including smart retries using merchant advice codes, implementing artificial intelligence (AI) optimizations, and working with unified platforms like Rapyd.

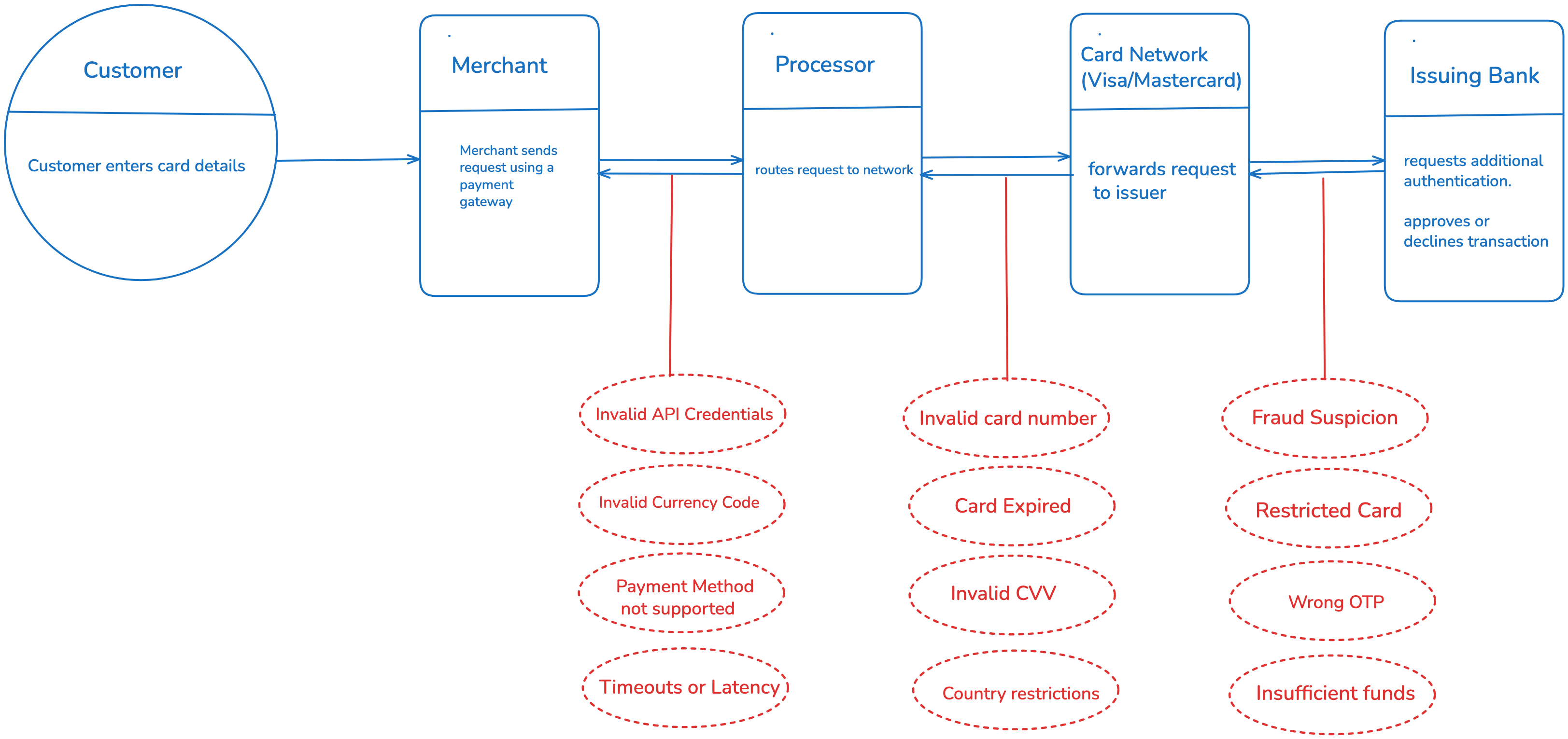

Understanding the Payment Authorization Funnel

Before you can boost authorization rates, you need to understand how money moves from the customer to the merchant. Each stage is a potential point of failure. Understanding the moving parts helps you anticipate the kinds of authorization errors that may take place at different stages and how to respond strategically.

Stages of an Online Payment

The lifecycle of an online payment begins when a customer submits their card details on the merchant’s application. That triggers an authorization request that is securely transmitted through a payment gateway (API) to a payment processor. The payment gateway and payment processor are often the same provider. Rapyd provides both services through one unified solution.

Next, the payment processor may initiate a 3-D Secure (3DS) flow if required. During this step, the issuer may perform additional checks, like one-time passwords (OTPs) or biometric prompts. Once authentication is complete, the authorization request is then routed through a card network, like Visa, Verve, or Mastercard. The network, in turn, forwards the authorization request to the customer’s issuing bank. Based on various signals, such as available balance, fraud checks, and card validity, the issuing bank ultimately decides whether to receive or reject the payment. The decision travels back through the same route to the merchant, where the result is displayed to the customer.

Declines and Visibility into the Funnel

Declines can happen at any stage in the payment process, from network outages and expired cards to incorrect PINs or CVVs, fraud alerts, or insufficient funds. However, not all declines are created equal.

A soft decline is temporary (eg network timeouts, insufficient funds) and may succeed on retry. A hard decline (eg stolen card, invalid number, wrong PIN) usually can’t be resolved on retry. Developers need visibility into this funnel to know when and how to respond.

For example, if a large portion of subscription payments fail due to expired cards, a retry will not be effective, but a card updater or reminder system may. This insight helps developers spot decline patterns and come up with strategies to prevent losing customers you’ve already spent money acquiring.

Implementing Smart Retry Logic with MACs

Merchant Advice Codes (MAC) are response indicators issued by banks or card networks that provide specific guidance when a transaction is declined. These responses usually follow a failed payment authorization attempt. The code helps the merchant determine whether the decline is temporary, permanent, or correctable. It can indicate whether to retry the transaction, prompt the customer for more information, or stop further attempts. By adhering to these codes, merchants can avoid needless retries and prevent damaging their authorization rates.

The following are some common MACs and their meaning:

| MAC | Meaning |

|---|---|

| 01 | Updated Information needed |

| 24 | Retry in the next hour |

| 30 | Retry after ten days |

| 43 | Card reported stolen |

| 55 | Invalid PIN |

| 7903 | Do not retry |

| 7921 | Do not honor |

The examples in this guide are primarily sourced from Mastercard’s MAC since MACs were first introduced by Mastercard. It’s important to understand the meaning of each code and how to respond effectively. For example, if the code indicates Do not retry, attempting the transaction again may trigger fraud alerts, chargebacks, fines, blacklisting, and reputational damage. You may forfeit any products or services that have already been delivered to the customer.

A code like Retry in the next hour suggests that the issue is temporary (eg the spending limit has been reached or the cardholder’s bank is temporarily unavailable). Some codes may point to missing or invalid data (in cases of an expired card or missing CVV), and if stronger customer authentication is required, merchants can prompt users to reenter or update their payment details or even go through a 3DS check. For subscription-based businesses, a card updater service may help avoid some of these errors entirely by refreshing card information automatically.

Retrying only when it is appropriate increases your success rate without triggering issuer penalties or risking chargebacks. MAC-aware retry logic helps maintain healthy issuer relationships, reduce failed attempts, and improve overall conversion rates.

It’s important to note that MACs are not standardized across all issuers or payment processors. Different card issuers may return different codes for similar situations or none at all. In some cases, the MAC hints only at the problem without giving the full picture. It may even advise a retry, but that doesn’t guarantee a successful retry.

MACs should be used as part of a broader diagnostic strategy that includes logging, analytics, and close coordination with your payment provider.

Using AI to Predict and Optimize Authorization Outcomes

Like so many other areas, AI is revolutionizing payments by enabling faster, smarter decision-making. For instance, when it comes to payment optimization, AI can detect patterns in payment behavior and adapt in real time by analyzing historical transaction data to do the following:

-

Identify high-risk combinations that are likely to be declined

-

Recommend the best time or method to retry a failed payment

-

Predict fraud and proactively block transactions that are likely to be flagged and rejected

AI models automate analysis and continuous learning, leading to the discovery of emerging patterns in your data. This helps improve authorization rates and payment efficiency.

Use Case: Training Models on Transaction Data

A common method for training AI models to predict authorization outcomes involves using a combination of historical and real-time transaction metadata. Here are some useful features:

-

Transaction amount

-

Card bank identification number (BIN)

-

Geolocation

-

Timestamp

-

Network quality

With enough data, you can train a model to predict success probability for each available payment route or method. This makes it possible to implement smart routing. For any incoming payment, the system calculates the route with the highest likelihood of approval and uses it. On failure, the system retries the transaction through the next most optimal route. This approach helps merchants increase authorization rates while reducing unnecessary retries.

How a Data-Driven Approach Boosts Success Rates

AI enables the following intelligent mechanisms within payment systems:

-

Data enrichment augments payment requests by adding personally identifiable information (PII) that issuers have historically valued in approval decisions (eg device information, geolocation). Issuers are more likely to make better approval decisions when they have more contextual information about the cardholder.

-

Dynamic retry automates retries based on an evidence-based understanding of MACs or with a different payment service provider.

-

Smart filtering filters out avoidable declines (eg expired cards, duplicate payment submissions, fraud risk payments, bot activity, brute-force attempts with card PINs).

-

Smart routing selects the most promising processor most likely to approve a transaction, based on historical approval patterns.

-

Insight generation uncovers patterns and root causes for declines, helping teams prioritize improvements.

While AI has the ability to transform fraud detection, it’s not without its challenges. Building, training, updating, and fine-tuning these models is complex work that demands massive data sets and serious computing power. Get the balance wrong, and you either block good customers (false positives) or let fraudsters slip through (false negatives).

Then there’s the regulatory maze. Data protection laws like the General Data Protection Regulation (GDPR) put strict limits on how you store non-anonymized customer data. Models must be designed to comply with these regulations by anonymizing and encrypting personal data.

However, here’s the thing: despite these challenges, AI makes payment systems more resilient and efficient—it’s worth the effort. Even simple rule-based models can help small teams get started. You don’t need a data science team or deep machine learning (ML) infrastructure to benefit from intelligent logic. Small teams can still improve success rates by implementing smart rule-based decision engines that handle MACs, flag common fraud indicators, or set retry thresholds. Over time, these systems can evolve into more sophisticated ML pipelines as resources and data maturity grow.

Partnering with a Unified Payments Platform

A unified payments platform offers end-to-end payment services, like acquisition, issuance, payouts, and digital wallets under a single provider. Instead of relying on multiple services for each step of the payment funnel, businesses can streamline operations, reduce costs, and ship faster by working with a unified solution.

One major advantage of unified payment platforms is full-stack orchestration. Since these platforms manage both the acquiring and issuing sides of the payment flow, they have more access to granular data, such as issuer response data and fraud signals. This gives them better intelligence about what issuer response codes actually mean and how to act on them.

For instance, platforms that issue their own cards or wallets can facilitate internal transactions with less friction, leading to faster approvals, lower fees, and fewer declines. While merchants can’t control which card the customers use, partnering with a unified platform significantly improves the likelihood of successful payment outcomes.

Rapyd supports payments, payouts, wallets, and card issuing under one umbrella. Even without ML support, the detailed issuer responses and metadata returned by Rapyd can serve as input for custom retry logic or AI decision models. This allows teams to improve retry outcomes without manually aggregating insights from multiple payment service providers.

Sample Project: Payment Retry Orchestrator with MAC Logic

This section walks you through a simple Node.js project that simulates multiple payment attempts and failure scenarios using MACs to guide retry behavior. The logic randomly fails some transactions and returns a corresponding MAC, which the orchestrator uses to decide what to do next: retry, prompt for a new method, or stop.

If you prefer local development, you can clone the sample project on GitHub by running the following:

git clone https://github.com/Rapyd-Samples/rapyd-payment-retry-orchestrator

cd payment-retry-orchestrator

You can also run this project instantly in your browser via StackBlitz, with no setup required.

The main components include the following:

-

index.jsis the entry point of the project. It runs a batch of transactions usingrunBatchand handles each one usingprocessTransaction, which simulates the payment, receives a MAC, and applies the appropriate retry logic. -

simulator.jscontains thesimulateTransactionfunction, which randomly decides whether a transaction succeeds or fails. On failure, it returns a randomly selected MAC. -

macLogic.jsdefines the functioninterpretMACto translate a MAC to an action. TheMAC_RULESobject provides a sample set of MACs to action mappings (eg retry, prompt, or halt). -

dashboard.jsincludes areportfunction that summarizes the outcome of all transactions that have run. It tracks metrics like total attempts, retries triggered, user prompts, and halted transactions. -

README.mdprovides setup instructions and ideas for extending the project with ML-powered predictions.

To run the simulator, in either your terminal or the StackBlitz terminal, execute the following:

node index.js

You should see the logs of each declined transaction and their corresponding meaning. After all the transactions have run, you’ll see a summary report of all transactions:

The goal isn’t to replicate a full production-grade payment system. But as a foundation, you can extend with more advanced logic with payment orchestrator platforms like Rapyd, or even with predictive AI models.

Conclusion

Declined payments are more than just lost revenue; they are pointers. By interpreting them and understanding the authorization funnel, developers can turn failed transactions into opportunities for recovery.

With the right tools, you can go further than reactive retries. Rule-based retry strategies, AI-driven optimizations, and unified payment orchestration platforms like Rapyd can help you make smarter decisions at scale. Developers who take decline codes seriously as data points, rather than as dead ends, build smarter, anti-fragile systems that improve success rates and customer satisfaction.